5.9 Billion € – Actual Status of 5G Auction in Germany

- Posted by Wolfgang Odenthal

- On 17. Mai 2019

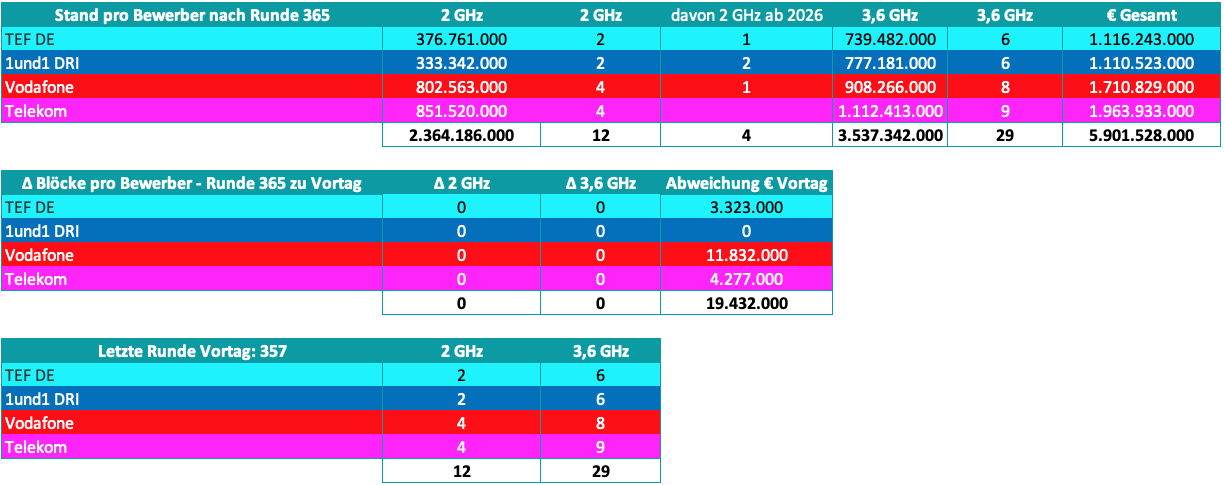

Summary of todays action in 5G Auction

Today we passed another line: 5.9 bn. € just for the „air“ and some hope of huge business in the next 10 years.

A short overview of the key development from today: +19 mil. €, no effective change in frequencies:

Rough Calculation

To bring license cost in relation to investment into 5G network, I do a very rough calculation on infrastructure investment (fiber/cable-network not included), how much it will cost to build a network of 98% coverage with some estimations:

- 2 GHz frequency band: around 178 tsd. cells required for 98% coverage and 2 square kilometer per cell (Germany: 357.000 square kilometer), estimated price per cell: 50 tsd. € => 8.9 bn. € for full pop coverage – per operator…. => 35.6 bn € in case of four competitors. That is a huge amount of money. Telekom Deutschland pays 850 mil. € for 4 Blocks on 2 GHz just for frequency licenses, 8.7% of total cost => 17 tsd. cells that could be built by Telekom instead.

- 3.6 GHz frequency band: around 350 tsd. cells required for 98% coverage and 1 square kilometer per cell, estimated price per cell around 60 tsd. € => 21 bn. € for full pop coverage – per operator…. => 84 bn € in case of four competitors. That is a huge amount of money. Telekom Deutschland pays actually 1.1 bn € for 9 Blocks on 2 GHz just for frequency licenses, 5% of total cost => >18 tsd. cells that could be built by Telekom instead of bidding for one „missing“ block.

- After reaching 5.9 bn € it seems to me an unreasonable amount of money just for licenses. It will not be helpful for German IT-infrastructure to have such high burdens for starting the investment for building 5G infrastructure.

Outlook and my expectations for the future development in the German 5G Auction

Next week the game will continue and the amount of money that goes to the state will rise further. In CW 22 earliest it will be more interesting, because then 1&1 frequencies will be back in focus. Then we will see that there will be no 4th Mobile Network Operator in final round of 5G Auction. Everything else would extremely surprising for me.

If it will come to an crowding out, I expect to see the following scenario: Telekom 11 on 3.6 GHz, Vodafone 10 on 3.6 GHz, Telefonica 8 on 3.6 GHz, Telekom 5, Vodafone 5 and Telefonica will get 3 2 GHz frequency blocks. My estimation for the blocks on 2 GHz: 175 mil. € each and 161 mil. € for 1&1 Drillisch blocks on 3.6 GHz band, if 1&1 will continue with one block less. This would lead to around 6.9 bn € for three mobile network operator – and it could get worse if 1&1 has even more money than estimated, or 1&1 Drillisch will reduce more bands before being victim of a crowding out. Then calculation above would come to a more extreme result: Telekom would roughly calculated spend 1.8 bn € for 3.6 GHz => 7,9% of total cost for infrastructure and frequencies, 1 bn € for 2 GHz => >10% of total cost for infrastructure and frequencies. That seems to be totally unreasonable. The amount of money just for Telecom could build 30 tsd. cells on 3.6 GHz and 20 tsd. cells on 2 GHz.

My conclusion

It is not a commercial calculation behind the strategy of the two big players Telekom and Vodafone. It is a strategy that wants to reduce competition on Business Customer segment. But it is a very expensive fight that will not have a positive influence on German IT-Infrastructure. I guess Vodafone and Telekom are fantastic operators, but 1&1 there is a need for a third very strong competitor (1&1 with its Versatel-Part) in B2B Segment. This could be a fantastic catalyst for new and better products on mobile business solutions . But however, that is exactly what Telekom and Vodafone want to prevent.

0 comments on 5.9 Billion € – Actual Status of 5G Auction in Germany